Empower retirement calculator

To learn what personal. What age do you plan to retire.

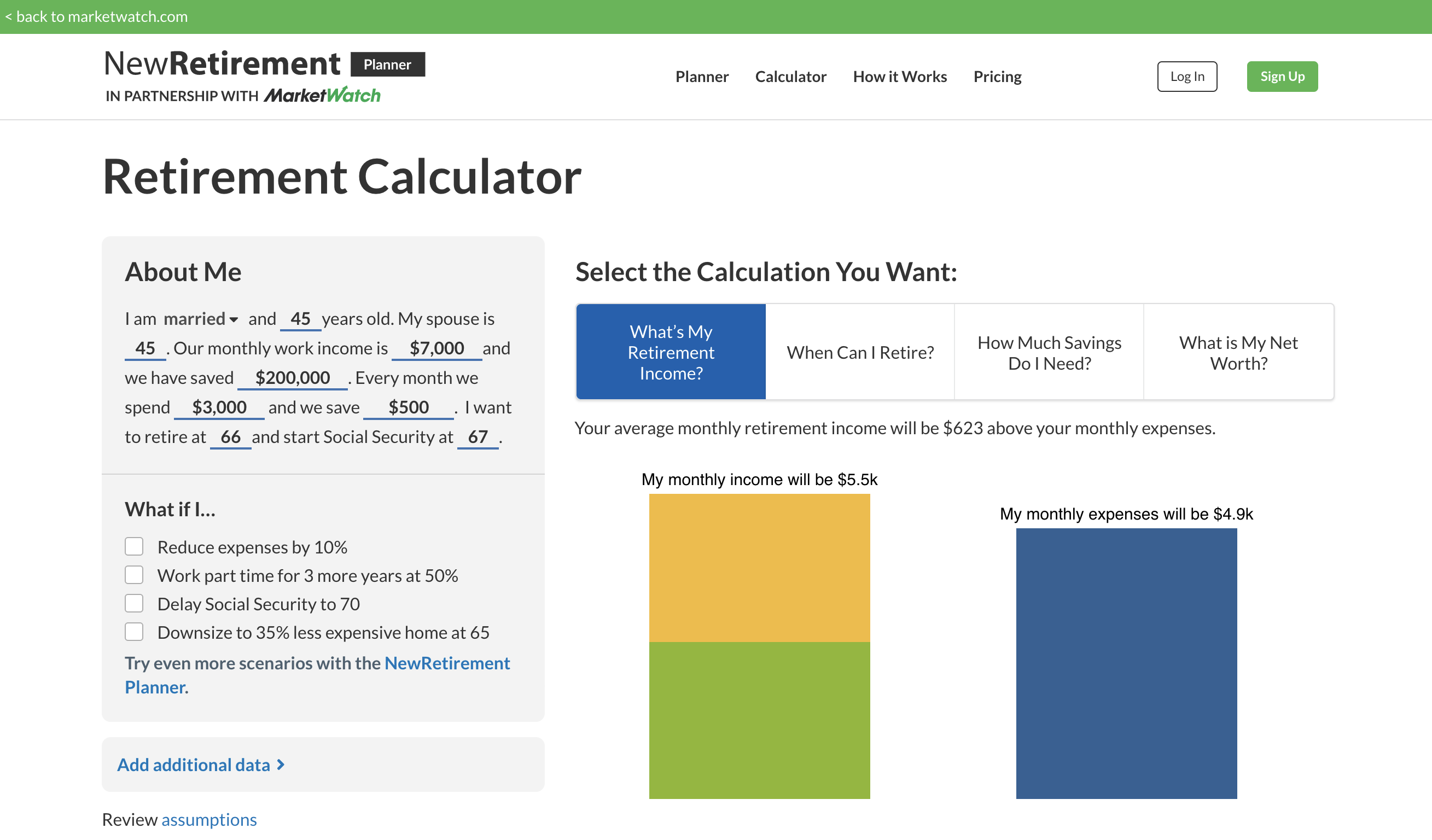

The 10 Best Retirement Calculators Newretirement

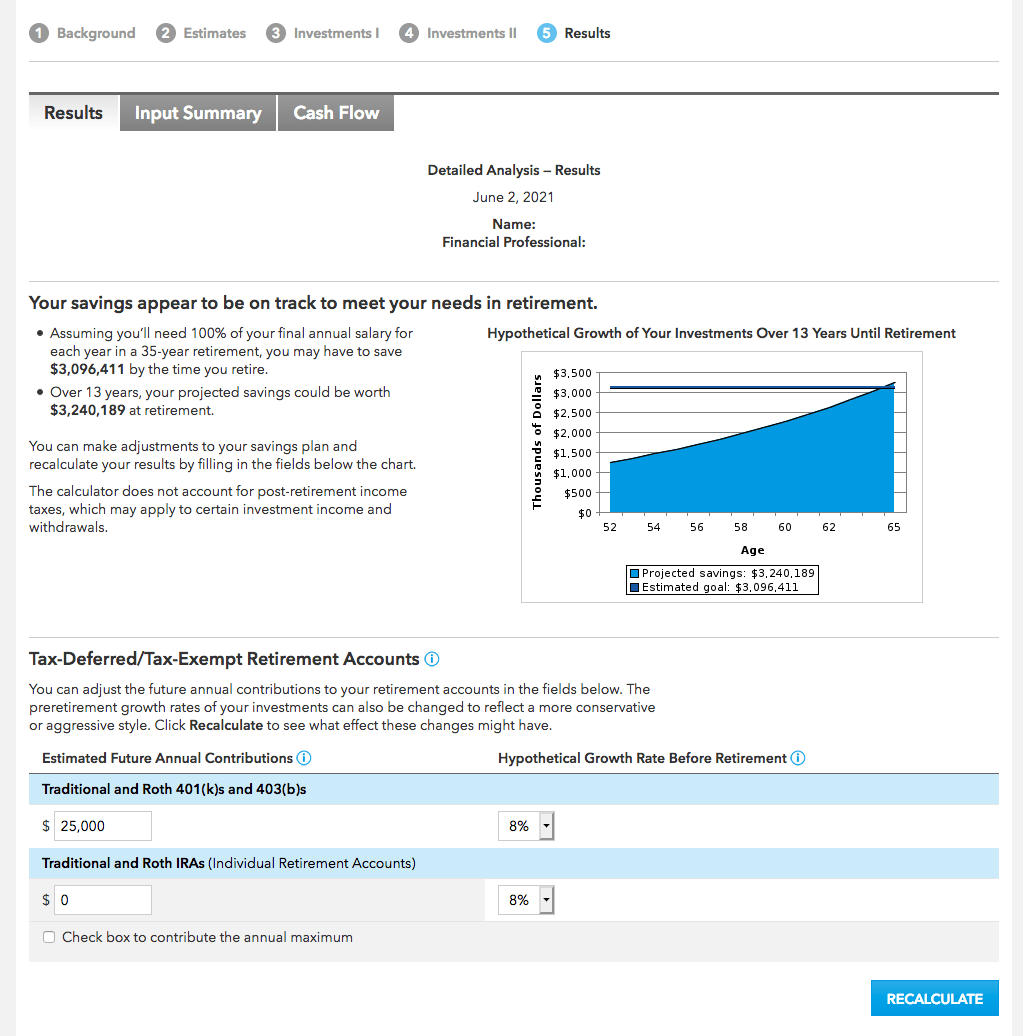

This pre-retirement calculator may help you determine how well you have prepared and what you can do to improve your retirement outlook.

. Empower Retirement - Learning center - Calculators - Withdrawals in retirement Home Calculators Withdrawals in retirement Print Withdrawals in retirement Understand the impact that annual withdrawals may have on your retirement account so you can estimate how many years your savings may last. Balance at retirement if account rolled over. With the Retirement Planner tool easily estimate how much you will need for retirement in just 5 simple steps.

Use this calculator to estimate how much your plan may accumulate for retirement. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Enter 0 if you do not plan to contribute while the loan is outstanding.

For government education healthcare and not-for-profit plans. Calculate the premiums for the various combinations of coverage and see how choosing different Options can change the amount of life insurance and the premiums. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement.

The results and findings presented by this calculator may vary due to user input and assumptions. Lump-sum distribution after taxes and penalties. The results and findings presented by this calculator may vary due to user input and assumptions.

Answer A Few Questions To Receive Guidance From AARPs Digital Retirement Coach. It does not make any adjustments for different classes of. Estimated length of retirement you could fund.

MassMutuals retirement calculator can help you better prepare for your retirement. Each calculation can be used individually for. Our Resources Can Help You Decide Between Taxable Vs.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Cashing out could cost you. Your required minimum distribution for 2039.

Evaluate how the life insurance carried into retirement. Calculators Borrowing from your employer retirement plan Print Borrowing from your employer retirement plan Understand the impact of taking a loan from your employer sponsored retirement account. Our Retirement Calculator can help a person plan the financial aspects of retirement.

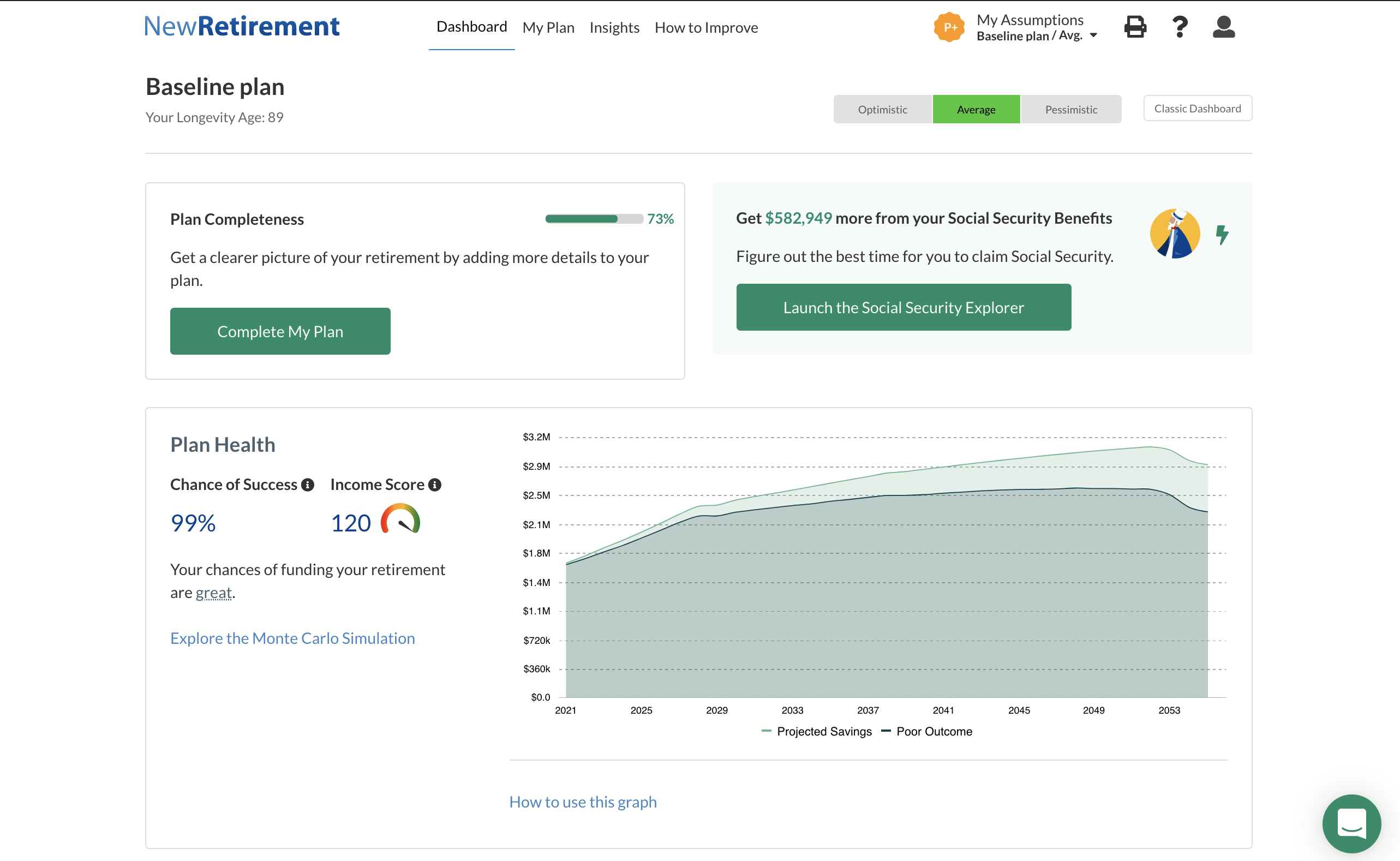

Retirement Calculator See how small changes today could affect your retirement success. Changes in economic climate inflation achievable returns and in your personal situation will impact your plan. Once youve entered your information the tool will display your retirement income projections and tips for closing any savings gaps.

Determine the face value of various combinations of FEGLI coverage. Calculators With our powerful easy-to-use financial calculators you can dig into the data and figure out the best course of action when it comes to spending saving and investing your money. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income.

It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your 401 k plan. Your lifestyle choices may have implications for your spending in retirement. Home financial retirement calculator.

This calculator will help you determine what your required minimum distributions will be under IRS rules. Federal Employees Group Life Insurance FEGLI calculator. If you are 70½ or older the calculator will estimate your next distribution.

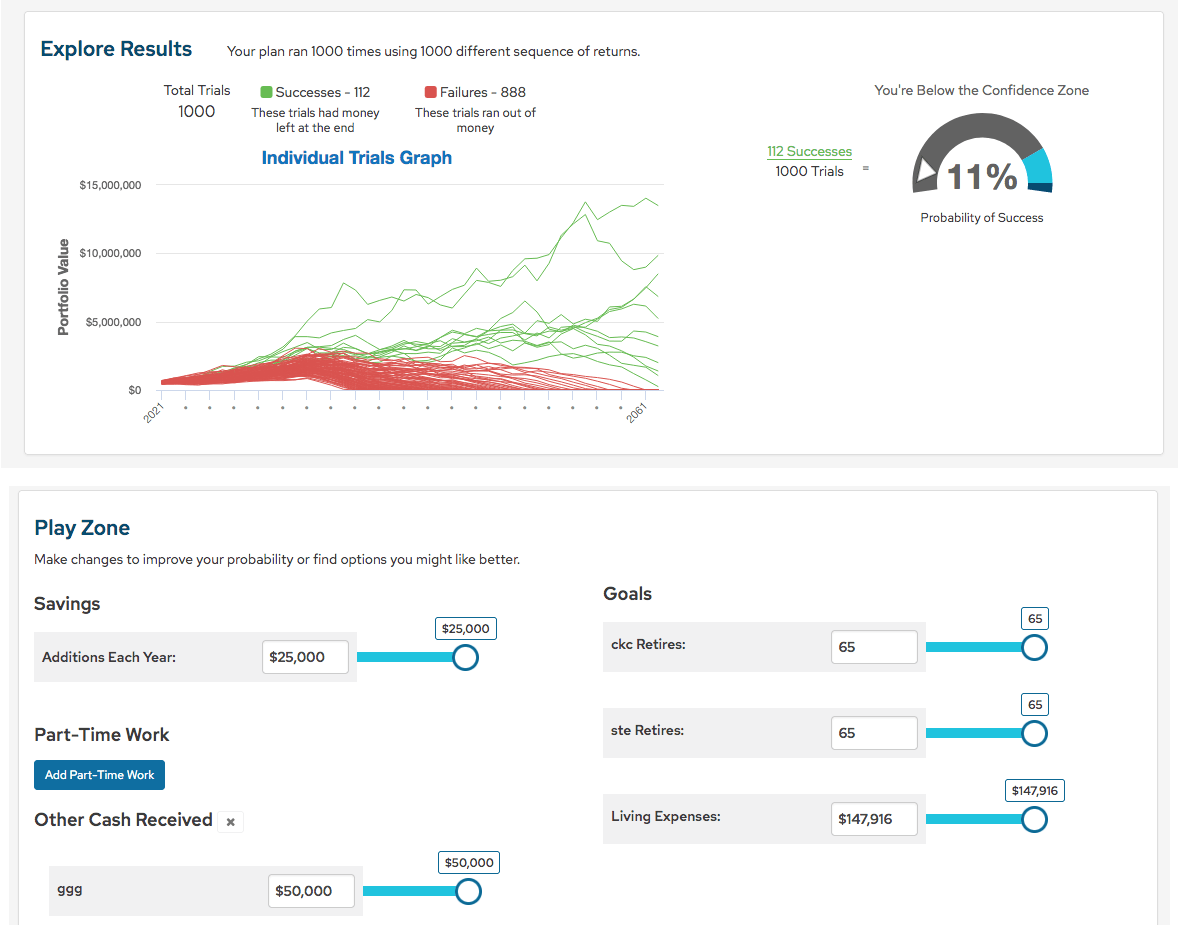

Read Full Disclosures. Use this retirement calculator to see if your portfolio is likely to support your retirement goals. A Retirement Calculator To Help You Plan For The Future.

This calculator allows you to manually enter information to produce very rough estimates based on SERS most basic pension formula. PCC is a wholly owned subsidiary of Empower Holdings LLC. PCC an Empower company.

Holders of traditional IRAs and other tax-deferred savings accounts are required to take minimum distributions once they reach age 70½. Planned Retirement AgeThe age when you plan to begin withdrawing money from your retirement account. Use this calculator to estimate how your lifestyle choices in retirement as compared to your current lifestyle may affect your expenses.

Our financial professionals can help you plan today. Borrowing from your savings may provide solutions in the near term but could negatively impact investment growth and cost you in loan fees. Percent of current salary you may need for this retirement lifestyle 102 102 of your current salary.

Free calculators that help with retirement planning with inflation social security life expectancy and many more factors being taken into account. To discuss your results in greater detail and for a more in-depth financial analysis use the contact form provided and a CFS Financial Advisor will contact your shortly. Empower Retirement - Learning center - Calculators - Minimum required distributions Home Calculators Minimum required distributions Print Minimum required distributions Understand when you will be required to begin withdrawing from your retirement savings and how much you will need to withdraw each year.

Current AgeYour age today. Years until retirement 1 to 50 Current annual income. Auto Loan Calculator Retirement Savings and Planning Savings Calculators Mortgage Calculators Pages within Tools Education Auto Center.

Note that the maximum employee contribution for 2021 is 19500 or 26000 if you are over age 50. How much do you and your employer plan to contribute per pay period while repaying the loan. Final average salary x years of service x class of service multiplier x 2.

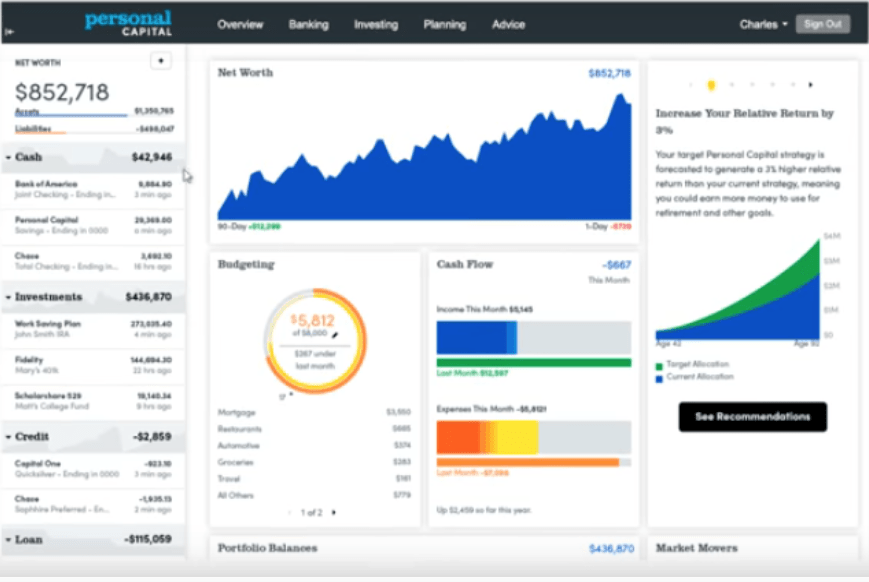

Ad Get Personalized Action Items of What Your Financial Future Might Look Like. It is important that you re-evaluate your preparedness on an ongoing basis. Our Retirement Calculator lets you forecast your retirement plan in one convenient location and is completely free when you join Personal Capital.

Simple Tips You Need To Stop Spending Too Much Money Budget Categories Frugal Frugal Tips

The Career Change Maker Podcast 60 Simple Ways To Improve Money Management With Christina Sjahli On Apple Podcasts Money Management Podcasts Finance Career

The 10 Best Retirement Calculators Newretirement

401k Contribution Your Best Move To Prepare For Retirement Preparing For Retirement 401k Plan Retirement Planning

How To Calculate Retirement Costs For Anything Camp Fire Finance Retirement Advice Retirement Strategies Retirement

Line Of Credit Tracker Line Of Credit Personal Financial Statement Student Loan Interest

The 10 Best Retirement Calculators Newretirement

Aarp Retirement Calculator My Financial Life Ma

7 Best Side Hustles To Make 1000 In A Weekend ǀ Empower Multimedia Side Hustle Money Basics Make More Money

The 10 Best Retirement Calculators Newretirement

Front Page Financial Management Starting A Business Business Tips

Pin On College Savings

30 Day Budget Bootcamp Calculate Your Household Net Worth Budgeting Net Worth Budgeting Money

Compound Interest For Beginners Compound Interest Financial Planning Binder Single Mom Saving Money

Empower Retirement Me My Money Calculators Pension Calculator

Pin On Financial Wealth

The 10 Best Retirement Calculators Newretirement