Calpers retirement chart

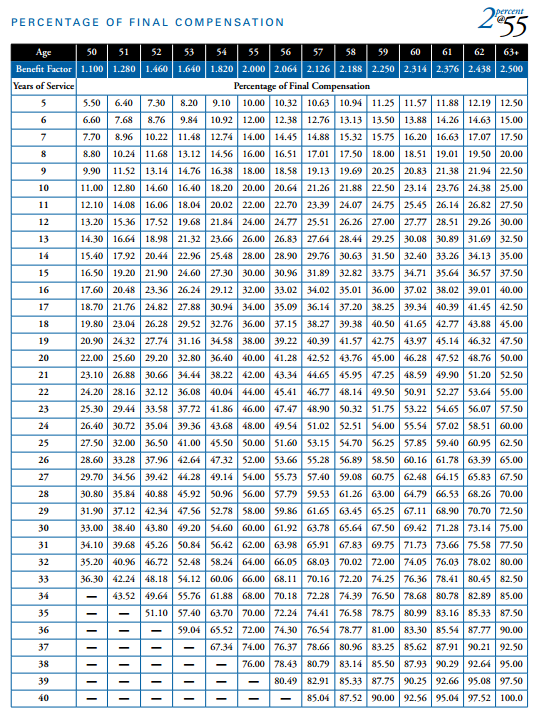

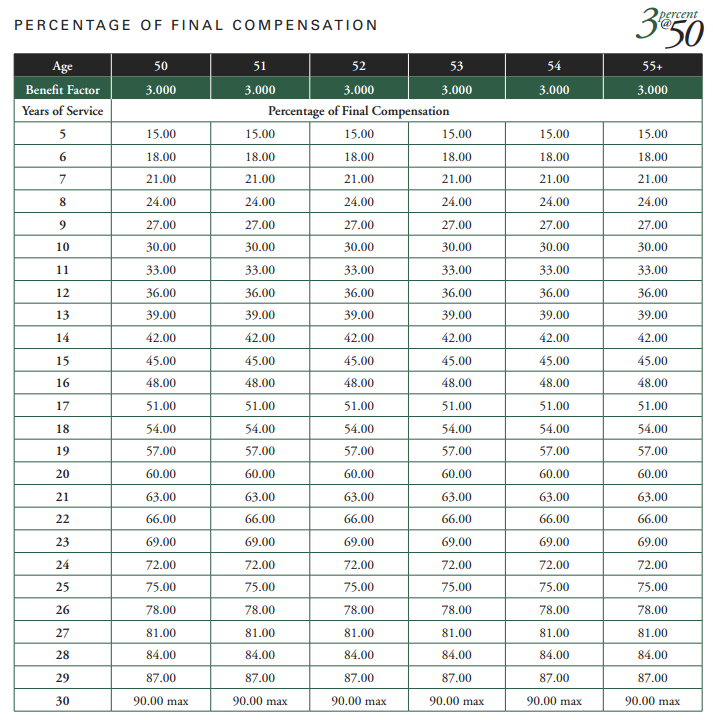

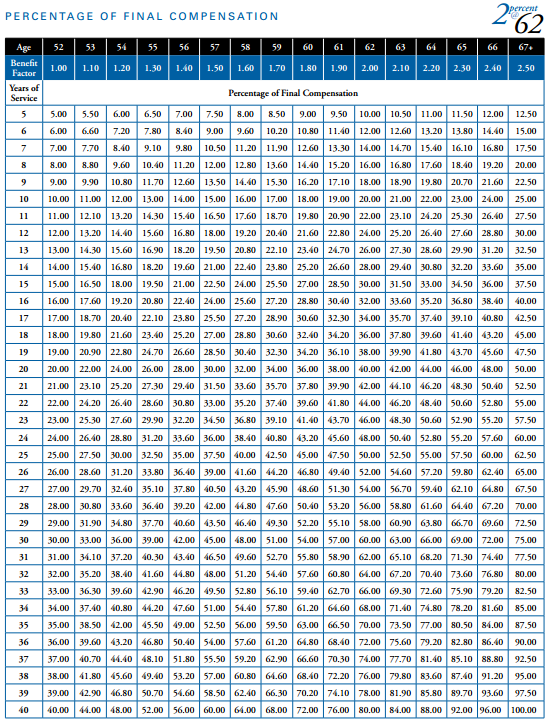

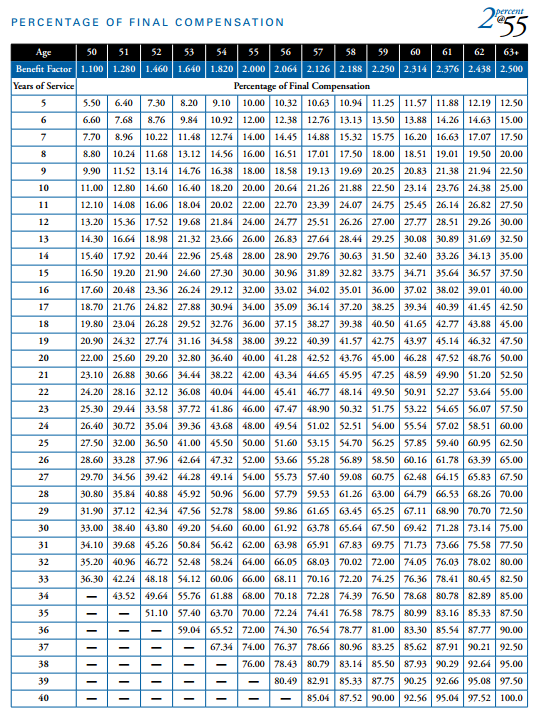

For example based on a State Miscellaneous Industrial members 2 at 55 formula you are eligible to retire at age 50 with a multiplier of 11. These calculations are made by dividing the average annual pension for a CalPERS participant in 2012 30456 by the average years of service 1993.

Csrs Fers Vs Calpers Vs Aarp Retirement Calculator Comparison Review Advisoryhq

Here are five facts to know.

. Use the CalPERS Retirement Estimate Calculator or log in to myCalPERS to estimate your monthly pension benefit. This is the percentage of pay you are entitled to receive for each year of CalPERS-covered service. Personal Leave Program 2012.

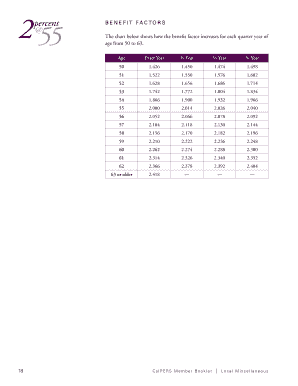

Once you reach your eligible retirement age your benefit factor increases with each quarter year of age or every three months based on your birthday until you retire. Active Members Retirees. Join the CSEA Retiree Unit for only 3 per month and retain your CSEA member benefits including the free 5000 Accidental Death and Dismemberment ADD access to group.

Get the Basics on Your Retirement System. It is a tax-deferred plan that allows you to take advantage of tax-deferred compounding. Annual Leave Comparison Chart.

Service credit is the time you accrue while on the job under a CalPERS-covered employer. The average pension for all service retirees beneficiaries and survivors is 36852 per year while service retirees receive 39372 per year. The CalPERS 457 Plan is for employees of participating public agencies and schools.

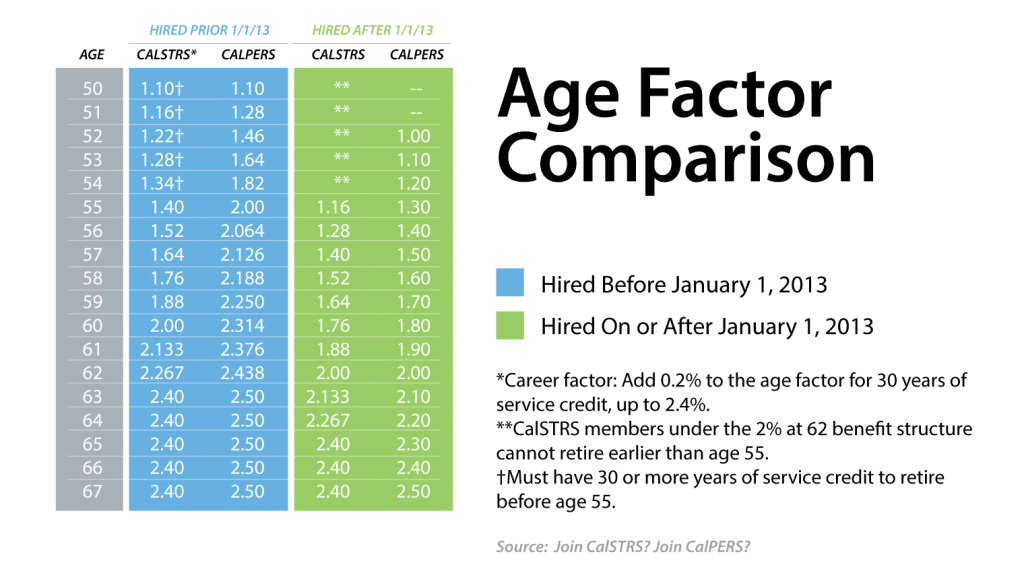

On January 1 2013 a Pension Reform legislation went into effect. Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Experienced Support Exceptional Value Award-Winning Education.

The minimum service retirement age for most members is 50 or 52 with five years of service credit. Ad Together well identify your wants wishes and needs for a comfortable retirement. Log in to your member or employer account.

By logging in to myCalPERS to create. Whether your retirement is decades away or already here we can help. The result 1528 is the.

But how much do you know about CalPERS. That multiplier increases every three. Employers Business Partners.

Excluded Employee Leave Buy-Back Program. Ad Its Time For A New Conversation About Your Retirement Priorities. Once you reach your eligible retirement age your benefit factor increases every.

The minimum retirement age for service retirement for most members is 50 years. Open an Account Today. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Its determined by your age at retirement. Lets start with some definitions. TD Ameritrade Offers IRA Plans With Flexible Contribution Options.

For the past 90 years we have proudly served those who serve California. This is whats known as. Ad Its Time For A New Conversation About Your Retirement Priorities.

Employees should refer to your CalPERS Annual Member Statement to verify your retirement formula s and you can view the applicable retirement benefit formula chart in one of the. Employees excluded from CalPERS membership are covered by the CSU Part Time Retirement Plan.

Mapping The 100 000 California Public Employee Pensions At Calpers Costing Taxpayers 3 0b

July 2014 Calpensions

Will Calpers Run Out Of Money Wall Street Fat Cat

07 July 2014 Calpensions

Calpers 2 At 55 Chart Fill Online Printable Fillable Blank Pdffiller

Calpers Retirement Chart 2 5 At 55 Chart Hd Png Download 568x1349 Png Dlf Pt

How Does Calpers Work If 2 At 62 Quora

How Much Do Calpers Retirees Really Make

Retirement Debt What S The Problem And How Does It Affect You Calmatters

2

Calpers Eyes New Rate Hike Capitol Weekly Capitol Weekly Capitol Weekly The Newspaper Of California State Government And Politics

Planmember Calstrs And Calpers Retirement Benefits

Have You Checked Your Benefit Factor Chart Calpers Perspective

2

07 July 2014 Calpensions

07 July 2014 Calpensions

Post Coronapocalypse Pension Reform Checklist For California